My dive into the school district funding has led to a lot of surprises for me.

I have one last surprise to share: Wooster is now paying the same share of our property taxes to our school district as when we set up the school’s funding 50 years ago.

I realize that is an extraordinary claim from me.

So, I want to take you on the journey that led me to this surprise.

It all starts with the property tax harvesting machines I have mentioned in my previous 2 posts.

Wooster schools are currently funded by 12 of these machines.

I want to be able to see and feel them so I made something that looks like board game pieces for each one.

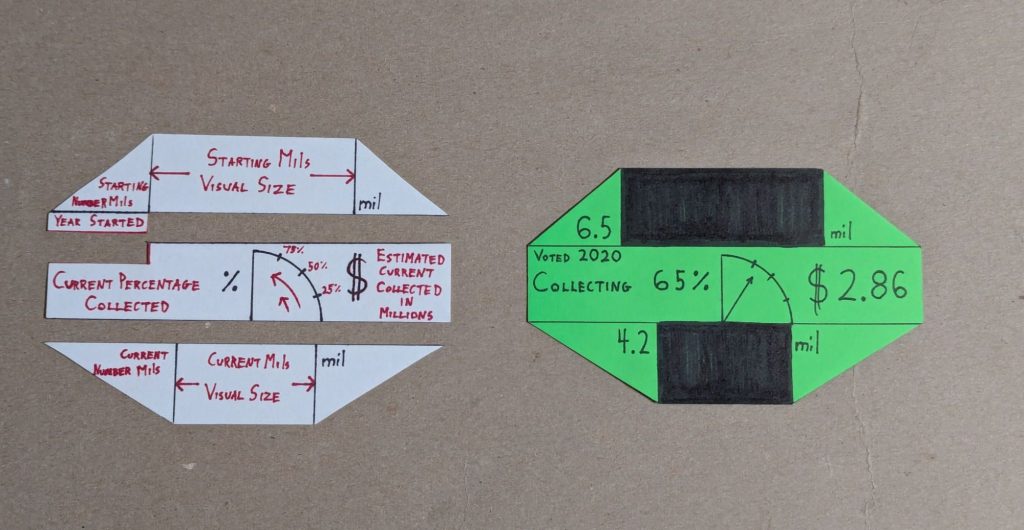

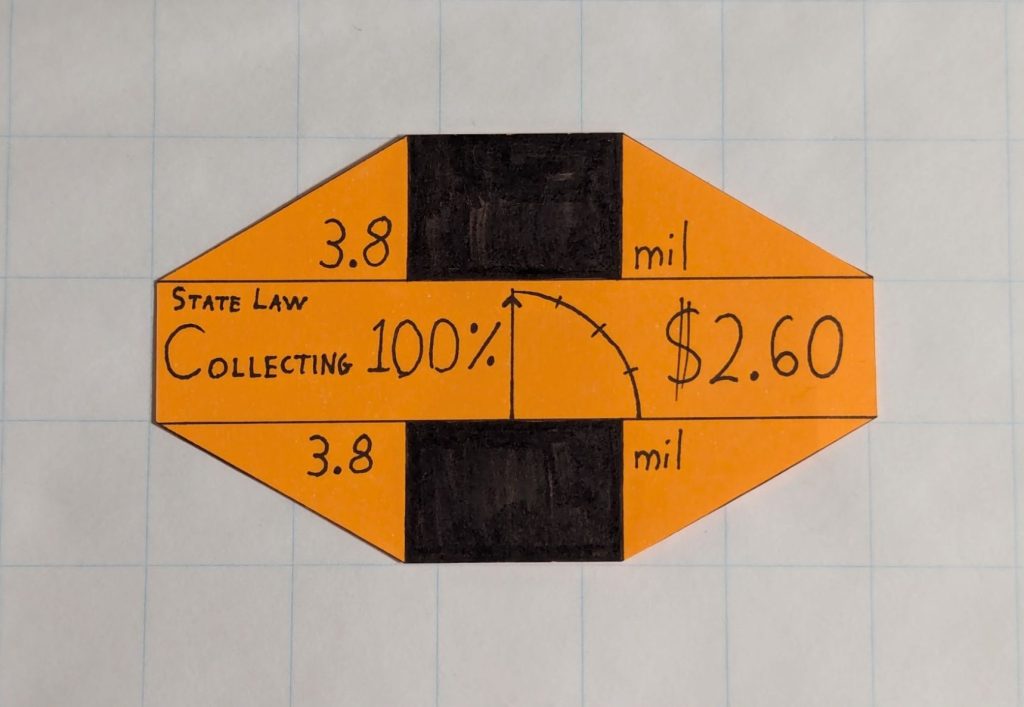

On the right is the most recent operations levy the community agreed to back in 2020.

On the left is how machines are constructed.

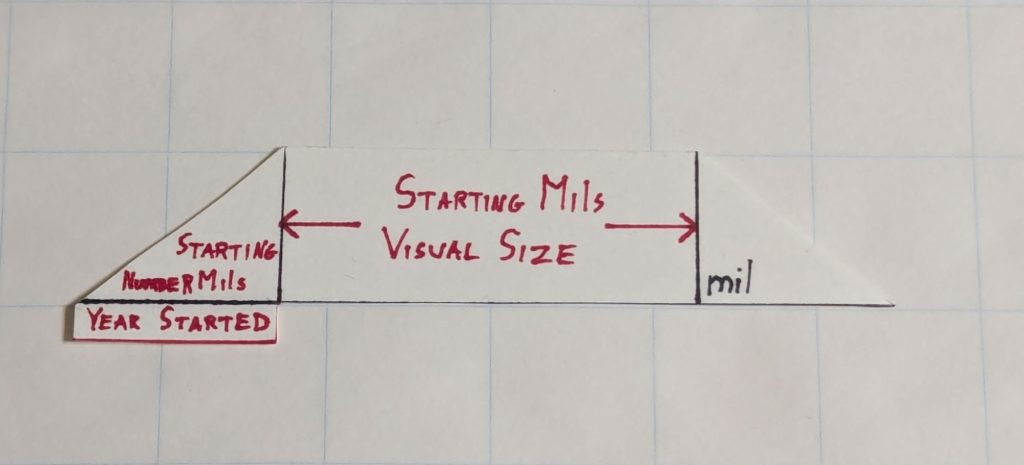

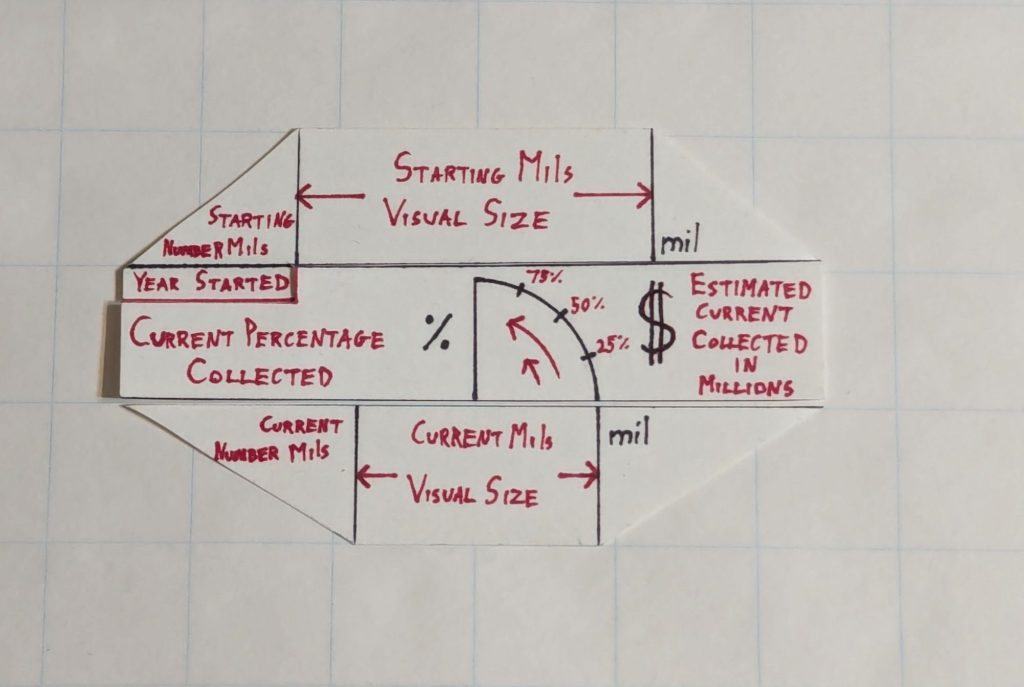

First, on the top, the district starts with a target share to be collected and a starting year.

The share is a starting number in mils with each mill harvesting 1/1000th of our property value.

To be clearer, a 1000 mils tax would have us paying the entire taxable value of our property every year.

The size of the mils is also visually represented by how wide the top of the piece is.

The machine on the right started set to 6.5 mils and was set to start in 2020.

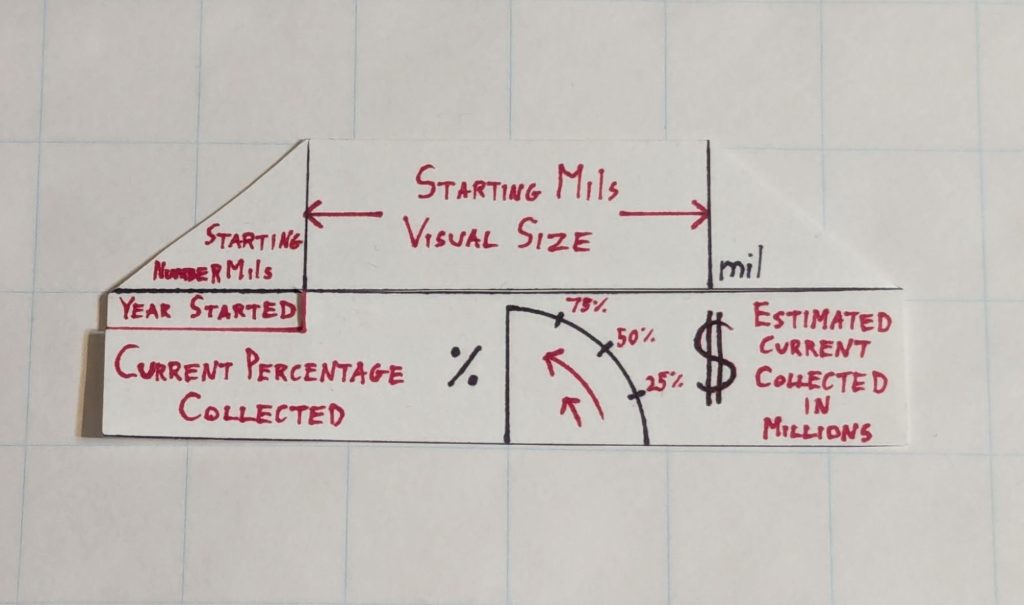

Moving to the middle step, this top part clicks into the machine controls.

The controls tell you how much of the starting amount is currently being collected.

From left to right, the controls display the current percentage, a visual gauge of that percentage, and the current amount of residential and agricultural tax collected in millions of dollars.

The machine on the right has been set to 65% power and it is collecting around $2,860,000 in tax from residential and agricultural property.

For the bottom step the machine shows how much it is currently harvesting.

At the left is the current effective mils of the tax rate and in the center the width shows the same thing visually.

If a machine has been throttled down over time the bottom bar and number of mils will be smaller than the top.

The amount of the difference between these will show how much the machine has been turned down.

If nothing has changed then the bottom and top will be the same and the machine has not been turned down at all.

This is how our tax harvesting machines are built.

With that format let’s look back through time at all the 12 machines still on the books and charging us tax to this day.

We will start with machines painted green like one on the right in picture 1.

This kind of machine collects what the State calls outside mils and can have its power turned down over time.

Tax that it collects goes into the general fund. [depositing into the silo from my first post]

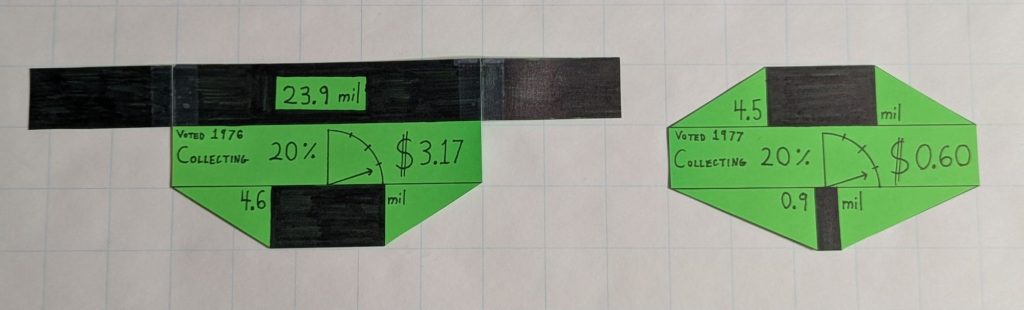

When school funding was reconstructed in 1976 the Wooster city district started with an enormous 23.9 mil levy.

This is the machine on the left and the milage was so big that I had to have the size of the bar fold out!

This was intended to fund the schools from scratch.

The very next year the community voted an additional 4.5 mils to be collected.

That was 50 years ago.

Inflation has significantly driven up property values since then.

So, using the State system, these machines have been dialed down to only 20% of their initial power.

The enormous first levy still collects the highest total dollar amount for the district, if only by a little.

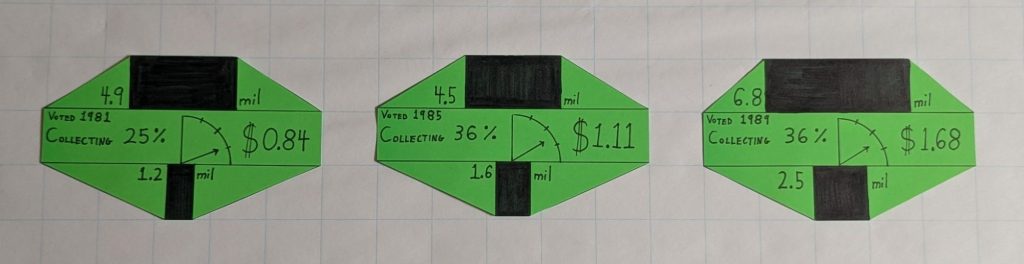

Because of the State system the district was forced to occasionally go back to the community to ask for operating levies, as the State intended.

The community fell into a pattern of agreeing to operating cost refreshes every 4 years.

The funding amounts are inconsistent so I assume the community felt different needs at different times.

The 3 machines from this era have been turned down at different rates since they are different numbers of years old.

All have been turned down well below half power.

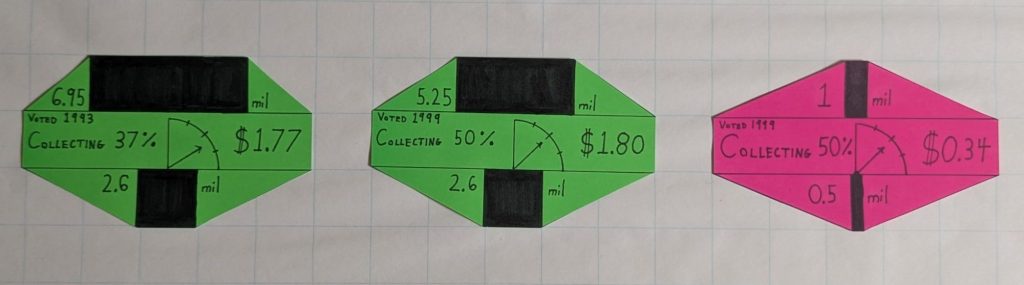

For whatever reason the 90’s machines break from the “every 4 years” timing.

After approving a refresh in 1993 the community waited 6 years to approve the next one.

In that same year they turned on another machine, the pink one on the right.

The pink machine was designed as a forced savings account for the district.

This is the one machine that feeds the Permanent Improvement account. [the chicken if you have read my first post]

This pink machine can’t be used to pay salaries and instead must be used to buy lasting improvements.

These machines have been turned down to about half power.

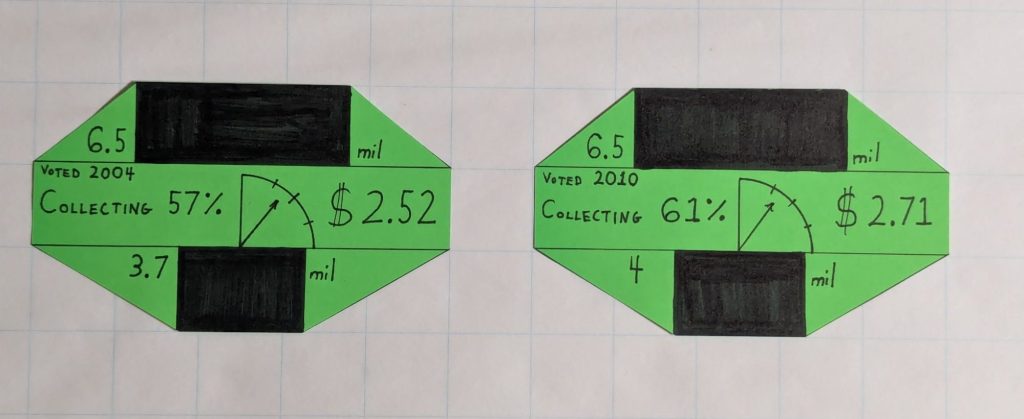

Since the 2000’s started, the community has settled into approving 6.5 mils at a time but the time intervals that have been needed for that have varied.

These have been throttled down but are still set somewhere between half and 3/4 power.

In the last 10 years I know of one temporary levy that was passed and expired, so I have included it as demonstration of how machines expire.

This pink machine on the left was an additional harvester for the Permanent Improvement funds.

After its 5 year term expired it was powered down fully and cannot be reactivated, so we no longer pay this tax.

This happened because the district did not seek its renewal.

Our most recent machine so far is the one I showed as an example in picture 1.

It has been turned down to 65% power because of our large property revaluation jump.

It collects the second highest total amount of money.

This orange machine is very different and collects what the State calls inside milage.

This machine cannot be turned down or up, it is always collecting the mils share it was set at.

For Wooster, there are 3.8 mils of inside milage that comes to the school district.

There are 10 inside mils in total that we pay and the other 6.2 mils are directed to other local government needs.

When our property value increased with the revaluation this machine jumped right along with that increase to collect more total for the district.

Before that increase the amount on this machine would have read $1.90 million instead of $2.70 million.

This $800,000 is the source of the about 4% increase of the school tax income.

This would have happened with every machine if the State system had not kicked in for Wooster’s outside milage.

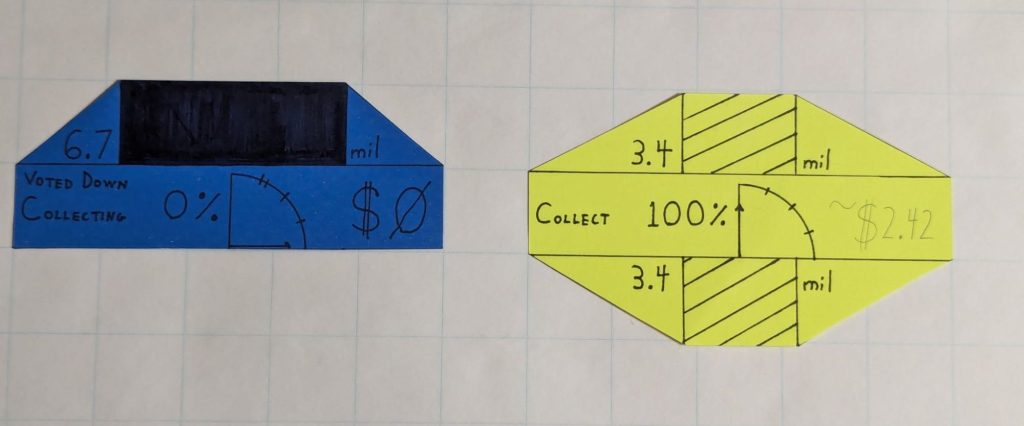

On the right, in yellow, is the proposed building levy on the ballot this May.

Similar to a pink machine, these funds cannot be used to pay salaries, nor can they be used for things not outlined in the bond. [This would feed only cows if you read my first post]

It would start set at 3.4 mils.

It is outside milage and so the machine can be turned down if our community property value goes up over time.

It will last no longer than 36 years, though it could be paid down to expire faster.

I have estimated it will collect around $2.42 million per year but that is a very rough guess that should not be thought of as solid.

The blue machine on the left is the failed building levy from 2023.

I have included it in the same format mostly to show the significant change in the starting mils.

The new plan is half the cost of the old plan and I thought it was interesting to see this visually.

Ok, enough with the pictures.

What about my claim at the top?

“Wooster is now paying the same share of our property taxes to our school district as when we set up the school’s funding 50 years ago.”

What do I mean?

50 years ago our community was setting up school funding from scratch.

They knew the orange machine was State mandated and would supply the schools with some share of property taxes no matter what.

But they knew the schools needed more.

So they set up a permanent operations machine set to 23.9 mils and the next year bumped it up with another 4.5 mils for a total of 28.4 mils.

After that the community fell into only refreshing funding every 4 or more years.

They had to refresh the funding because the State system was designed for the schools to need to go back to the voters to do just that.

Without the refreshes the school share would be proportionally less and less as the machines were naturally turned down as property values progressed through time.

Now to my claim: We are now at that same proportion.

If you add up all our outside milages you will get 76.3 mils.

But that isn’t what is being collected because the machines have been turned down to different rates.

If you add how much is actually being collected we are at 28.3 mils.

That is basically dead on the 28.4 mils the community decided was the correct contribution 50 years ago.

That was quite a shock to me.

But there is something hidden in there.

We are only NOW at that share after the State system kicked in and dropped our effective tax rate by 10 mils.

That does not speak well for how much we were being taxed before that system kicked in.

Somewhere along the course of that 50 years of history the community agreed to a bigger and bigger share of our property value going to support the school district.

That is on top of whatever temporary and building projects that were agreed to and have expired since.

I included the one pink machine from the 2010’s in picture 6 as an example of that.

I think we were always intended to have temporary, even decades long temporary projects that required their own machines.

I also think we were always supposed to agree to new operating machines to cover for them losing power over time.

I am not sure that share was supposed to go up quite as much as it had.

Wooster has always valued education highly.

But I don’t think I valued education any less in the 1970’s.

The levy being voted on in May is not permanent and so I take no wisdom from this surprise on whether that should pass or not.

I am none the less impressed that the State system has managed to bring us back to our starting point, 50 years distant.

The State system is complicated and hard to understand.

I have grown to appreciate it nonetheless.

Leave a comment